News

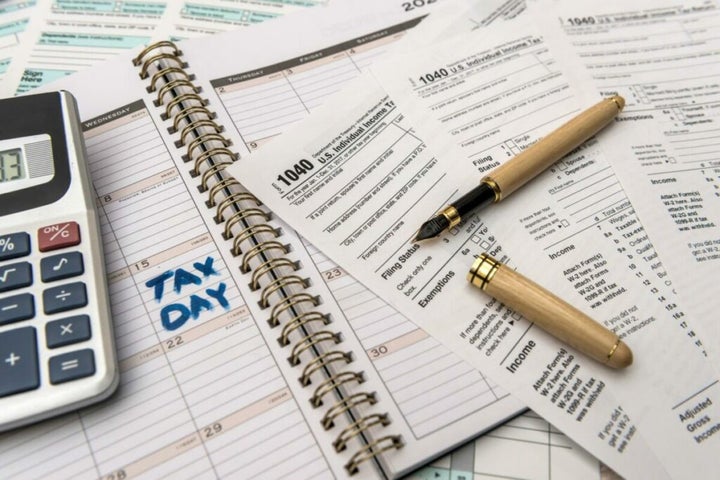

The Last Minute Scramble: What You Need To Know About Filing Your Return On Tax Day

Are you ready for the tax filing season? Here are some tips to help you along.

- April 18, 2023

- Updated: April 18, 2023 at 2:02 PM

If you’re planning to submit your federal income tax return today, it’s crucial to keep in mind that the deadline hasn’t passed yet. However, if you’re not ready to file your return, you can request an extension instead of feeling pressured to complete your tax return by the deadline.

It’s worth noting that there’s no magical solution to finish tax preparation immediately. Some individuals are automatically given extensions, such as U.S. citizens and resident aliens who live and work outside of the U.S. and Puerto Rico, as well as members of the military who are on duty outside of the U.S. and Puerto Rico.

Taxpayers who live in certain states that have been impacted by natural disasters may also be given extra time to file their returns. Nevertheless, it’s important to emphasize that an extension to file does not extend the deadline for paying taxes.

Are you required to file for tax?

To determine if you need to file a federal income tax return, you can use the chart provided. If your gross income exceeds the threshold for your age and filing status, you must file a federal income tax return. Typically, taxpayers who earn less than $12,950 (or $25,900 for married couples filing jointly) are not required to file a federal tax return.

However, even if you’re not required to file, it could still be advantageous to do so in order to claim certain tax credits, such as the Earned Income Tax Credit.

Filing a paper return

If you choose to file a paper return, it is important to note that you must mail your return using first-class mail before midnight on April 18 in order to meet the filing deadline. However, sending your return via first-class mail will not provide proof of mailing. To meet the requirements under section 7502 and obtain proof of mailing, it is advisable to send your return via certified or registered mail.

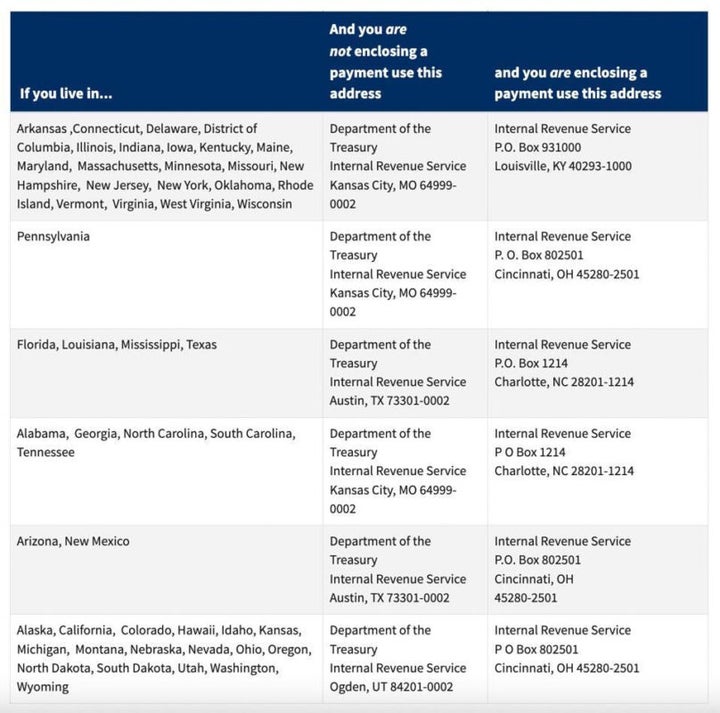

Please keep this in mind when submitting your return either in person or through the USPS website. Additionally, it is essential to use the correct address in order to fulfill the timely filing requirement. To ensure accuracy, refer to the IRS chart.

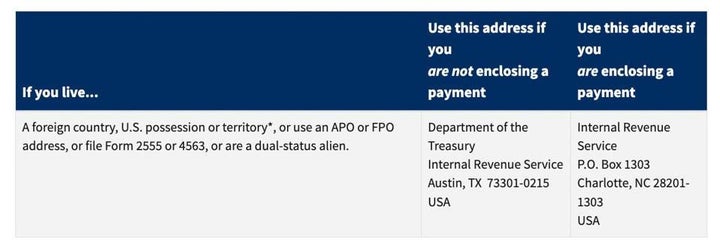

If you reside outside of the 50 states, please use the following address:

If you need to personally visit the post office, you can utilize the Post Office locator tool to locate a convenient location and verify their hours of operation. Alternatively, you may use a private delivery service in place of the post office. To meet the “timely mailing as timely filing/paying” rule for tax returns and payments, the IRS has designated a list of private delivery services which can be found here.

However, regardless of the method you choose to submit your paper return to the IRS, it is important to prepare for a waiting period. The IRS advises that processing paper returns may take up to 6 months.

E-Filing

To avoid the inconvenience of mailing a paper return, you have the option to e-file by the deadline. The IRS recommends e-filing as it saves time and allows for a faster refund. If you choose to e-file, you should expect to receive your refund within three weeks after the IRS receives your tax return. If you have the refund directly deposited into your checking or savings account, you may receive it even sooner.

Furthermore, if you earned less than $73,000 in the previous year, you may file for free at IRS.gov.

Need extra tax assistance?

If you require accessible products like refreshable Braille displays, screen reading software, or screen magnifying software, you can visit the online Alternative Media Center. This online center provides tax forms, instructions, and publications in formats that are accessible.

Moreover, if you need to order tax forms, instructions, or publications in large print or Braille, you can call 1-800-829-3676.

Language options

If English is not your primary language, you may use Form 1040(SP) in Spanish, which is provided by the IRS. Furthermore, if you require assistance in other languages, the IRS has translated certain materials into 20 languages.

Making your payment

If you owe taxes, it is recommended that you make a payment as soon as possible, ideally the entire amount due, before the deadline to avoid any penalties and interest charges. You have various payment options available, such as paying from your bank account, debit or credit card, or using your digital wallet.

If you are unable to make a payment today, it is important to file your return on time in order to minimize the penalties. The current interest rate for unpaid taxes is 7%, compounded daily. The late-filing penalty is typically 5% per month, and the late-payment penalty is usually 0.5% per month. Both penalties have a maximum cap of 25%.

Tax help is always available

If you have any final questions before submitting your tax return, you can visit the IRS website for various resources that can help you. These include the Where’s My Refund? tool and the Interactive Tax Assistant (ITA).

The ITA, in particular, is very helpful because it can provide answers to questions that are specific to your situation, such as whether you need to file a tax return, your filing status, whether you can claim a dependent, if you have taxable income, or if you are eligible for specific tax credits.

Keep calm and pay your taxes

Tax Day can be a stressful time for both taxpayers and tax professionals. However, it’s important to avoid becoming overwhelmed by the pressure. Simply do your best, and if there are any unresolved issues, make sure to follow up on them as needed.

It’s essential to keep in mind that Tax Day is only one day, so try to take a deep breath and remain calm.

You may also like

Google Gemini vs Apple Intelligence: Is there a winner?

Read more

Samsung Vs Apple: The Smartphone Battle Heats Up- And Other Compelling Stats You Can’t Miss

Read more

iOS 18.2 and ChatGPT: This is everything we can do

Read more

It's already Christmas in GTA Online: access new bonuses and gifts

Read more

Dune: Prophecy is renewed for a second season on Max

Read more

Clint Eastwood’s latest movie finally arrives on Max; why should you watch it?

Read more